While it seems like we are trapped in the never-ending rat race of struggling to keep up with inflation, all is not lost. Admittedly, it might seem like such, with GST rates reaching an all-time high of 9% and salaries seemingly stagnating.

This might be a thought that keeps many of us up at night, but with some nifty tips and tricks, it is more than possible to not only survive the tumultuous economic landscape but still have some room left over to indulge yourself.

If you find yourself scratching your head when it comes to stretching your dollar, look no further! Here at SmileTutor, we have compiled just a few helpful ways to manage the rising cost of living without making drastic changes to your lifestyle.

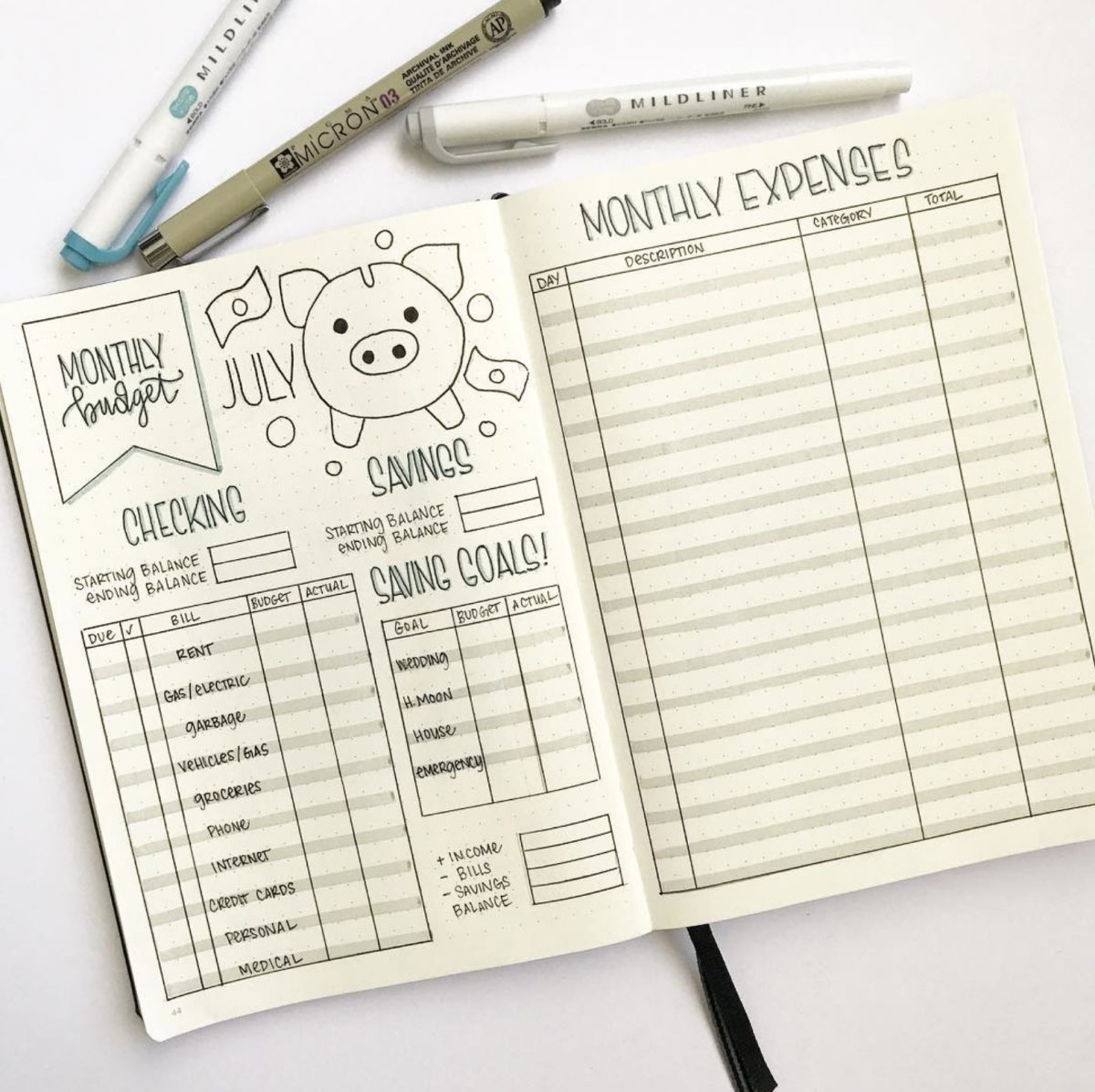

Budgeting and Expense Tracking:

Develop a detailed budget that outlines your income and all your monthly expenses. For people who are just starting out in budget tracking, the volume of transactions and things to input might seem overwhelming.

To help with that, stick to using one form of payment so that your expenses are easier to track at the end of the day. If you are using cashless payment, try to pay using the same card or account, so that your expenditures are easier to tabulate when you need to update your expense sheet.

Set aside money for your necessities first, which include things like bills, transport and food. Whatever is left behind can be spent on things that are more wants than needs, like entertainment, shopping and hobbies and tuition.

It might seem redundant to track your spending so meticulously, but it actually helps you to identify areas where you can cut back or find more cost-effective alternatives.

If the manual method of expense tracking is too time-consuming or complex for you, consider using budgeting apps or tools to stay organized and monitor your financial situation.

Public Transportation and Carpooling:

With the increasing options for ride-hailing and private hire cars, many of us have fallen victim to the trap of overspending on public transport. After all, for most of us who do not drive or own a car, private hire vehicles are seemingly the fastest and most hassle-free way to get to our destination.

However, these services come at a cost, and with the average private hire ride amounting to around $20, these convenient rides will add up. Not to mention, ride-hailing services sometimes implement additional charges, like surge pricing and peak hour prices. A ride that would have maybe cost $20, can very easily shoot up to over $35 at peak hour.

If you must take private hire vehicles, opt for the carpooling option for a lower price, or schedule your rides in advance for lower pricing. Avoid taking private hire rides at peak periods, and make full use of discount codes when you can find them. Some credit cards offer discounts if you use them to make payments, so keep an eye out for deals that pop up within the app. The best solution to save money would ultimately be making the switch from private hire to public transport. Singapore’s public transportation system is efficient and well-connected. Consider relying on public transport to save on commuting costs.

To avoid having to rely on last-minute rides, plan out your journey in advance, giving you ample time to use public transport to get to your destination. When faced with a long commute, use this time to perhaps read to book, catch up on your latest episode of K-Drama, or simply take a power nap— if you’re lucky enough to snag a seat!

Meal Planning and Cooking at Home:

When going to the office, having to purchase your lunch every day can add up. Especially if you work in high-traffic or more touristy areas, dining out in Singapore can be pricey. Even if you choose to eat cai fan every day, your $5 meal, not including drinks or tea break snacks, will end up costing you an additional $30 a week!

Multiply that by 4, and you can find yourself shelling out around $120 a month on lunch alone. This is not taking into consideration the prices of meals in the CBD area, which can very easily be double that amount for the same dish.

Plan your meals in advance and cook at home whenever possible. You can very easily kill two birds with one stone, and use meal prep time as a bonding activity for you and your loved ones.

Preparing your own meals allows you to teach your children the importance of being able to cook, which is an essential life skill. You can also take this opportunity to foster a love for healthy food and educate them to make good choices when it comes to their diets.

Buying groceries and preparing your own meals not only helps you control your food expenses but also allows you to make healthier choices. Not only that, preparing food yourself allows you to cater your meal to your own unique taste, so you can have your oyster omelette with no oyster— judgement-free. After all, nothing beats a home-cooked meal!

To boost your savings even more, shop at local wet markets and keep an eye out for promotions to save on grocery costs. At checkout, make use of your CDC vouchers if you haven’t yet, to lessen the strain on your wallet.

Take Advantage of Government Subsidies:

Singapore offers various government subsidies and schemes to assist residents with specific expenses, such as healthcare and education. Familiarize yourself with these subsidies and check if you qualify for any.

If you rely on long-term medication or have chronic healthcare needs, medical bills can very quickly spiral out of control. Explore options like the Community Health Assist Scheme (CHAS) for medical expenses.

To help defray costs for your young ones in school, you can consider looking into the Edusave scheme for education-related costs.

Feel like you’ve done your best at pinching pennies but still want to supplement your income? We might have the solution for you. If you have extra hours on hand and the capacity both physically and mentally for a side gig, perhaps you can consider joining us as a freelance tutor?

Freelance tutoring is a popular choice for those still schooling, or looking for additional hours to supplement their part-time job.

Not only will you pick up a little extra income, but you also pick up valuable skills like teaching, which are always in demand in a competitive environment like Singapore.

Remember, managing the cost of living is about making informed choices and finding a balance that aligns with your financial goals. Regularly review your budget and adjust your strategies as needed to adapt to changing circumstances.

Remember, managing the cost of living is about making informed choices and finding a balance that aligns with your financial goals. Regularly review your budget and adjust your strategies as needed to adapt to changing circumstances.