Let’s face it, opting for higher education can be tough without a student loan. The massive burden of tuition fees, school supplies, hostel dues, and whatnot is enough to break the bank.

So, what are the best student loan providers in Singapore? That we’ll find out today.

You may be tempted to skip straight to the option with the lowest interest and flexible repayment, but there are other considerations to take into account as well that you may not know of.

Hence, I suggest going through the complete guide for a detailed understanding of getting a student loan in Singapore. It will help you to make an informed decision.

I’ll be covering key queries including:

- Do You Qualify for Study Loans In Singapore?

- Things to Consider Before Taking Out A Study Loan

- Top 5 Best Student Loans In Singapore

- Are There Any Options for Foreigners?

- A Cost Comparison To Put Things Into Perspective

- Do I Have Any Alternative Options?

- Final Words

Ready? Let’s jump right in.

Requirements for Student Loans: Do You Qualify for Student Loans in Singapore?

Before reaching out to a service, it’s important to know whether you qualify for it or not.

The requirements for borrowing loans vary from organization to organization. If one bank requires a certain amount of income, the other allows for a less stringent setup. Similarly, there’s a distinction between interest rates and the repayment time provided.

However, some general requirements and policies are similar among different banks and loan institutes such as:

- The guarantor (the parent or guardian of the student) must be an adult and must not be a discharged bankrupt

- The student must not have a scholarship or a loan in possession from a registered Govt. agency

- The student and the guarantor must be permanent citizens of Singapore. International students, don’t be alarmed – many banks also offer student loans for foreign students.

Read on to have a detailed idea of the key features, eligibility, repayment requirements, and application of each loan service in Singapore.

Things to Consider Before Taking Out a Student Loan

Following are the key aspects to take into consideration before applying for a student loan:

Eligibility for The Loan

The #1 thing to know when taking out a student loan is whether you’re eligible for it or not. Each loan service comes with a distinctive set of requirements, and terms and conditions, put in place as protective measures by banks.

Wherever you’re borrowing the loan from, make sure to either go through their requirements online or take complete information from one of their offices. However, the basics generally remain the same.

Naturally, either you or your family member should have income proof and be a permanent citizen of Singapore. Although foreign students can also borrow loans in Singapore while studying here, the process is a little more complex and so are the requirements.

After you’ve got complete information about your eligibility for the loan, it’s time to:

Know Your Repayment Method

Knowing how you will return the loan is an essential factor to consider before taking out a student loan. Are you financially stable enough to be able to return the loan within the repayment period? Do you think you’ll start earning enough right after education to do so? Will you be able to save up enough in time?

You get the point, right?

Figuring out the possibility of repaying the loan isn’t a necessity only for your financial security, but also for that the loaning party. Banks won’t consider you eligible for a loan unless you show proof of income and prove that you can return it within the pre-decided time.

Carefully Go Through Terms and Conditions

Reading the terms and conditions is essential if you want to ensure your loan doesn’t cause any issues down the road.

You see, loan services can have certain policies that don’t suit your criteria at all. Some may seem unnecessary or even extremely restraining. It’s likely that your consultant won’t be explaining each and every clause listed in the T&C. So before you sign the contract, it’s essential to have complete knowledge of exactly what you’re getting yourself into.

Interest Rate and Its Increase With The Repayment Period

Let’s say you’re looking to borrow S$1000 – do you think you’ll have to return the same amount once you’ve graduated? Hate to burst your bubble but, this isn’t how the banking system, or more precisely, the loan system, works. Loan schemes always come with interest rates.

Ideally, you want to look for a loan service with the least interest rate. Secondly, remember that the interest increases as soon as the repayment period expires. So, make sure that you can afford the amount you owe and can return the loan on time.

With that said, let’s move on to the best institute offering student loans in Singapore.

Top 5 Best Student loans In Singapore

The following are the best student loans in Singapore. We’ll take a closer look at the policies and requirements for each option, so you have a detailed understanding. We’ll also look at a cost comparison to determine which loan service is most suitable.

Let’s get started.

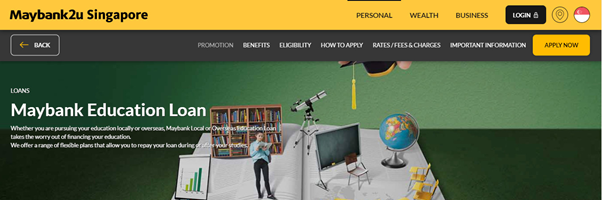

Maybank Bank Student Loan

If you find that completing your education without taking a loan is tough, Maybank is a loan service you might want to consider. The winning point for Maybank is its provision of flexible plans to help students live their education-related dreams.

The interest rates at Maybank start from 4.45%. Attractive! Isn’t it? Not just that, the bank offers you to apply for a loan 8x your (or your guarantor’s) monthly income and a flexible repayment period of 10 years. Meaning that you can even return the loan on your own.

Eligibility

- Singaporean and Permanent Residents

- Applicant (student): 18-65 years of age

- Guarantor (if required): 21-65 years of age

- Applicant (student-local part-time studies): Minimum S$18,000 annual income

- Guarantor (if required): Minimum S$30,000 annual income

Frank by OCBC Singapore

Here, I’ve got another suitable option with a relatively low and attractive interest rate of 4.5%. Another marvelous policy from Frank by OCBC is applying for a loan up to 10x your monthly income or S$150,000 (whichever is lower). The scheme offers flexible repayment options for up to 8 years. Impressive! Isn’t it?

Eligibility

- The student should be aged 17 years old or above

- The joint applicant must be Singaporean or have Singapore PR and aged 21 or more

- The joint applicant must have an annual income of S$24,000 minimum

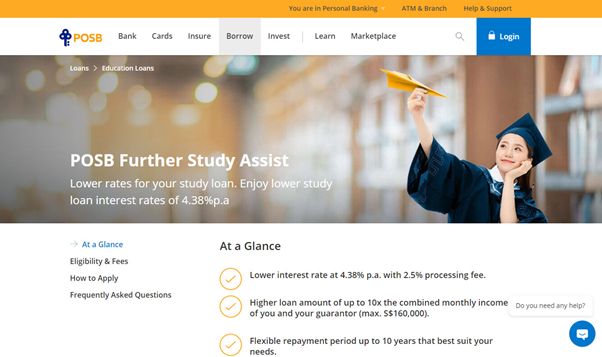

POSB Bank Student loan

Finding a loan service with the least interest rate is often a priority. When it comes to the POSB bank, they’re offering quite competitive interest rates and processing fees starting at 4.38% and 2.5% respectively. The bank allows you to request a loan amount of up to 10x your monthly income with a flexible 10 years’ repayment period.

Eligibility

- The borrower must be Singapore Citizen or Singapore Permanent Resident

- The borrower must be between 17 – 65 years and have a minimum annual gross income of S$18,000

- The guarantor must be between 21-65 years, be a family member of the borrower, and have a minimum gross income of S$24,000.

CIMB Bank

Although the interest rate isn’t that competitive, CIMB becomes a considerable option with flexible repayments packages in place to help you reduce the interest rate, which is 4.78% at its lowest.

Eligibility

- Only Singaporeans and Singapore permanent residents can avail of the loan

- A guarantor is required if the applicant is below 21, doesn’t qualify the minimum income criteria of $2000/mo., or if the loan requested is more than 8x of the applicant’s income

DBS Bank

Just like the previous options on the list, DBS bank has managed various student loan plans that include study loans, tuition fee loans, and so on. But what makes it stand out is the enormous 20 years’ repayment period to make things much simpler. Another marvelous policy of the bank is the interest-free service during education.

Eligibility

- The applicant must not have received a scholarship or loan from any other service

- The guarantor should be aged from 21 to 60 years

- The guarantor must not be a discharged bankrupt

With that said, let’s move on to the next point that you may have been waiting for:

Are there any options for foreigners?

You see, nearly all the banks presented above come with the requirement for the borrower to be a Singaporean resident. So, what about foreign students? Are there any alternative options for them? Let’s see.

Maybank and Frank OCBC

Maybank and Frank OCBC are so far the only student loan services I recommend for foreign students. These banks offer student loans to overseas (see the images below) students at competitive interest rates with long repayment periods.

Maybank student loan for overseas students:

OCBC student loan for overseas students:

Here’s a cost comparison to put things into perspective

The following comparison table gives you quick insights into the interest rates and other basic aspects of student loans among different banks.

| Student Loan Service Name | Starting Interest Rate | Highest Repayment Period | Lowest Income Requirement for Applicant | Lowest Income Requirement for Guarantor | Processing Fee | Applicant Age Requirement | Guarantor Age Requirement |

|---|---|---|---|---|---|---|---|

| MayBank | 0.0445 | 10 years | S$18,000 annually | S$30,000 annually | N/A | 18-65 years old | 21-65 years old |

| Frank by OCBC | 0.045 | 8 years | S$24,000 annually | N/A | N/A | 17+ years old | 21-65 years old |

| POSB Bank | 0.0438 | 10 years | S$18,000 annually | N/A | 2.5% of the approved loan amount | 17 – 65 years | 21 – 65 years |

| CIMB Bank | 0.0478 | N/A | $2000/month | N/A | 2% of the approved loan amount | N/A | N/A |

| DBS Bank | 4.38% after the study period is complete (interest-free during the study period) | 10 years | S$18,000 annually | S$24,000 annually | 2.5% of the approved loan amount | 17 – 65 years | Aged from 21 to 60 years |

Do I have any alternative options?

Not everyone wants to take out a student loan from banks due to their strict policies, higher interest rate, or such. So, what’s the way around it? Are there any alternatives in place? Fortunately, there are a few options to consider.

Scholarships

The best way around getting a student loan is to go for a scholarship. If you think you’re eligible for one, give it a shot. You know the difference: a scholarship will get you nearly free education while a student loan is more like a burden on your shoulders. Right?

But I feel you, not everyone is lucky enough to score for scholarships. If it sounds relative, here’s another option to consider.

CPF Education Scheme

If you think that you’ll easily get a job within the first year after graduation, give yourself a pat on the back, you may meet the requirements of the CPF education scheme. The program allows students to borrow loans to meet their educational expenses but comes with the strict requirement of repaying the loan right after the first year of completing higher education. If you’re interested, you can apply for the loan online.

MOE Tuition Fee Loan

MOE stands for the Ministry of Education (Singapore). The Ministry of Education is providing tuition fee loans to students willing to continue with higher studies despite the tight budget. Students in autonomous universities and polytechnics can apply for the loan.

Eligibility

- The students studying full-time in any of the polytechnic institutes can apply for the loan

- The students studying full-time subsidized undergraduate and postgraduate programs in the autonomous universities are eligible for the loan

- The Singapore Citizen students studying part-time subsidized undergraduate programs in autonomous universities.

Personal loans from licensed moneylenders

You see, educational institutes, schemes, and banks aren’t the only places where you can get a loan for your studies. Taking loans from licensed moneylenders is another considerable option for you.

These licensed moneylenders are provided with a license from the Govt. and offer loans with relatively lower interest rates. All your contracts with the licensed moneylenders are properly signed by both parties and kept secure by the Govt. itself. This way, borrowing personal loans from moneylenders becomes a reliable approach.

Final Words

Higher education costs a lot. It costs an arm and a leg, it breaks your bank and whatnot? You know it, I know it, and these loan providers know it.

To overcome the financial expenses of higher education, taking a student loan may be a worthy approach.

When finding the best student loan for yourself or your kid, make sure to go with the one offering the lowest interest rate, as well as a flexible repayment method, to make it easy on your pocket.

I hope you’ve got all the information you came here looking for. I wish you luck in finding the most suitable student loan in Singapore for you!