Ding! You’ve received a WhatsApp notification.

It’s coming from an unknown sender.

“YOUR DAUGHTER IS KIDNAP. IF YOU WANT HER SAFE BANK $5000 NOW. DONT REPORT POLICE!”

Faced with such a message, what would you do?

Panic overwhelms your senses. Ignoring every single red flag along the way, you pray that you’ll make it before your daughter’s captives change their minds.

You rush to a bank and transfer the money immediately.

As unlikely as the above scenario may seem, thousands of people from all walks of life fall for scams daily.

Don’t worry. It’s not too late to be aware of scams! To begin, how about asking yourself these questions:

What are the types of scams in Singapore? How can I protect myself & my loved ones?

This article has EVERYTHING you need to know about scams in Singapore. A word of caution, this is a LONG article. We’ve provided an index for you if you have a specific topic you want to jump to!

What is the definition of a Scam?

[iStock/JK1991]

Scams go by many names; a fraud, hoax, or social engineering— scamming has always been part of society since the days of old when the term “snake oil salesmen” was popularized.

They can come in different forms; Emails, phone calls, advertisements, phone messages or even your social media, oftentimes attached with offers that seem too good to be true.

The aim of a scam is always to deceive you for money or personal information by promising something of value to you in exchange.

As times evolve and new technologies emerge, scams have also become more and more sophisticated.

In this article, we’ll go through the most common types of scams we face today so that you’ll be prepared when you encounter them.

What Are The Most Common Scams in Singapore?

[The Straits Times]

We have identified 5 of the more prevalent scams that continue to plague locals today.

1. Job Scams (25.7%)

2. E-commerce Scams (20.2%)

3. Phishing Scams (13.4%)

4. Investment Scams (7.2%)

5. Love Scams (>7%)

According to SPF, damages to scams amounted to over S$330 million from the first half of this year alone, with the percentage of victims going up by over 60 per cent compared to last year.

It’s important to note that these numbers only represent reported cases, and the actual numbers may be higher as there are also a significant number of victims who choose not to report being scammed due to various reasons.

Job Scams in Singapore

“All you need to do is to participate in this survey. Fill this up and we’ll send you the money!”

Every job scam begins like this.

A seemingly low-risk, low-effort endeavour at first glance. But when the scam moves to the next phase, your “employer” will find a sudden inability to send the money to you.

“You’ll have to send a small fee in order to collect your salary.”

Yep, that is the ‘small fee’ which you’ll never get back.

Job scam is a a fraud in which job seekers are misled into paying money or providing personal information in exchange for a promised payout that never materialises.

Besides completing surveys, job scams can also take various forms, such as fake job listings, work-from-home schemes or pyramid schemes.

The aftermath of these job scams only lead to financial losses, identity theft, and other serious consequences for victims.

Common Victims:

Jobseekers who are desperate for employment, housewives who have spare time and in need of extra income, or young and naive students who have little to no experience working in the real world.

After all, a job with flexible hours, high pay and minimal effort is definitely going to catch the eyes of the gullible.

How to Spot Job Scams:

1. Promising High Salaries

What they say: “No experience is required for our job! You can earn a $4K salary working from home.”

The ”employer” will promise high salaries over market rate, often with little to no experience required.

⚠️ Scammers have adapted to “easier tells” and have lowered payouts to more believable numbers. However, the jobs remain easy and well-paid for the effort required.

An example of this is leaving short 1-minute Google reviews or completing surveys for S$20 each.

This means that doing this job for a standard 8 hours would net you at least S$9000 a day!

2. No Proper Company Name

What they say: “We are Durian Trading Limited, are you interested in a fast and easy job?”

The “employer” comes from a company that does not exist, or gives obscure results when looked up online.

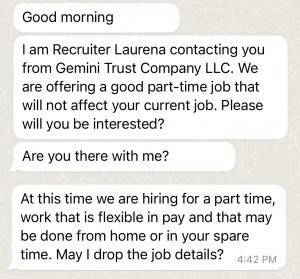

⚠️ Scammers change company names to fit the relevance of their scripts. Having Google, or even “Gemini Trust LLC”, a legitimate company name may deter people from digging deeper into the “employer”’s credibility.

3. Poorly Written Details

What they say: “You just have to post Google reviews for us, simple job!”

The jobs described by the “employer” will have poorly written details on specifics pertaining to duties, requirements, and qualifications, if any.

The scammer only crafts what is relevant to the scam as part of the story. Try to stretch their script and catch inconsistencies when they’re improvising.

4. Overly Flexible Hours

What they say: “You can work anytime you want!”

The “employer” proposes flexibility in work hours in order to widen the range of victims.

5. Requires Upfront Payment

What they say: “We will need you to pay $30 upfront so that we can get you the license to start work.”

The “employer” will require payment for job applications or training, especially through unofficial and non-government channels.

6. Uses Broken English

What they say: “Yes, we sen money to you today, pls no worry.”

The “employer” speaks or types in broken or incomprehensible sentences. This can also be accompanied with unprofessional speech.

7. Uses Over-Complicated Language (aka “Mumbo Jumbo”)

What they say: “Our company’s goal is to ascertain high sales volume through Google Search metrics so that we can properly push our company towards location visibility.”

The “employer” can try to overcompensate with the script by using buzz words frequently.

⚠️ Scammers sometimes befuddle you with buzz words like “cryptocurrency” or other industry terms to have their jobs appear more authoritative. This may cause some people to accept their legitimacy from that alone.

How to Prevent Job Scams:

[The Straits Times]

When you’re job hunting, you leave your resume and personal information for prospective employers. This can leave a moment of vulnerability— When you receive a message through WhatsApp or Telegram, it may come from someone genuine who chanced upon your profile.

But it can also come from a scammer.

Identify the warning signs so that you do not fall prey to fake jobs that are trying to steal your money! When in doubt, always ask the “employer” to clarify anything that is unclear.

Approach the conversation with a clear head so that you can understand what you’re signing up for.

Test Your Knowledge!

Now that you’re more informed about Job Scams, let’s put that knowledge to the test and see if you’re susceptible to falling for a job scam!

One fine day, you receive a WhatsApp message offering a fantastic job opportunity:

Can you spot the red flags here? Do you think this is a real job opportunity?

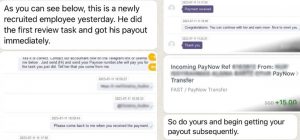

When you’re ready, let’s move on to the next one! You’re being offered $15 for each survey done. The employer sends you evidence of past payouts.

Do these look real to you? Would you sign up to do the surveys?

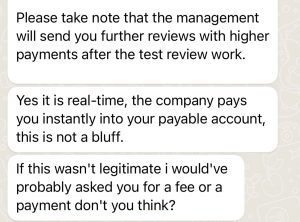

What about this last one? The employer tries to convince you that the job offer is real.

How many of the above offers were real?

If you’ve answered none, then congratulations~ That’s full marks!

Always remember, when in doubt, ask yourself this, “Is this too good to be true?”.

If the job was so easy and profitable, how did it fall into your lap without any effort?

Phishing Scams

“HELLO,” The email begins.

“Our billing team can’t debit your nominated card due to missing information on your payment details.

Please renew your subscription to avoid any delay on your service.

Click on the link below to renew now:

“

Would you be one of the many individuals who entertains such an email? It’s SingTel after all, surely it’s official right?

How about an SMS from “Ninjavan” sent to you while you were waiting for some of your Shopee packages to arrive?

When information can be sent to anyone without a filter in this day and age, it can be easy to fall for a phishing scam.

But just how convincing can these phishing scams really be?

All it takes is a click of a link for the scam to start. Read on to learn more about phishing scams!

Common Victims:

“The people who are more connected in the digital (world), the people who deal with it day in and day out and are comfortable with clicking on links – they are all vulnerable.” says David Chew, Commercial Affairs Department director for the police force.

Anyone who uses the internet can fall prey to a phishing scam. Especially individuals who are less tech-savvy or are less careful with their personal information.

In fact, figures released this year revealed that the majority of phishing scam victims came from between 20 and 39 years old.

How to Spot Phishing Scams:

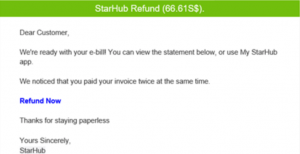

[ScamAlert]

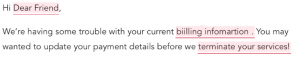

1. Missing or Generic Salutations

What they say: “Hi Dear,”

[Singtel]

What they say: “Hi Dear,”

Scammers do not know your identity YET! They begin by greeting you without evidence of being able to identify you.

2. Spelling Errors

What they say: “Billing informartion.”

Scammers often make mistakes in their writing that make them seem unprofessional and suspicious. Read its contents carefully and check for mistakes or inconsistencies in punctuation, font sizes and styles.

3. Creating a Sense of Urgency by Using Threats

What they say: “Send payment before we terminate your services!”

Scammers may use threats to create a sense of urgency to get you to act quickly before you have time to think. But always remember that most legitimate services will not ask for sensitive information over email, SMS or social media platforms.

Also known as the loss aversion bias, scammers have since evolved to using scare tactics instead of fake giveaways and prize-winning notifications.

After all, humans perceive loss more than an equivalent gain. Scammers have used this behavioural trait to induce fear and obtain sensitive information from their victims.

⚠️ From winning S$1,000,000, to a potential criminal charge for laundering money.

Which of these messages would be more likely to catch your attention?

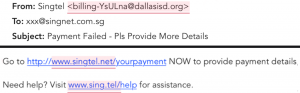

4. Similar but Fake Addresses

What they say: “Singtel <clearlynotsingtel.org>”

Scams usually come from addresses or links that resemble legitimate ones but contain subtle differences or typos, so it’s important to check what the official domain is before you click on anything else!

5. Suspicious Attachments & Links

What they say: “strangeapplication.exe”

Do not open or download suspicious attachments from unknown sources, as they may contain malicious programs or viruses. High-risk attachments include file formats such as .EXE, .ZIP, .SCR, .DOC, .TXT.

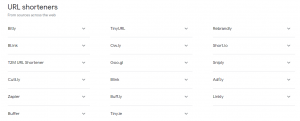

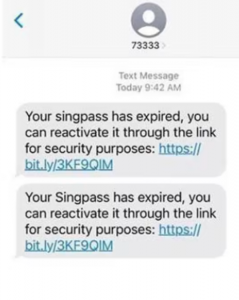

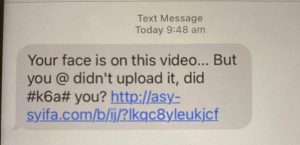

⚠️ Links are also no exception. Scammers often use URL shortening services to obscure their fake addresses. Here are a few URL shorteners that are commonly used (but not limited to):

A good rule of thumb is to only click on links that only contain the official site domain.

⚠️ Scammers will also use addresses very close to the original to trick you. “Sing.tel.com” or “singtel.net” won’t do, just “singtel.com”! Always check before you click on a link!

How to Prevent Phishing Scams:

Scammers have adapted to the times, making phishing scams harder to detect. When you receive a counterfeit message or email, it can be hard for you to differentiate them from legitimate ones.

But worry not, there are still useful tips on how to prevent phishing scams.

1. Always Verify the Sender’s Identity!

If you’re suspicious of the message being a fake, check Google for the following:

Is the address sent from the company/service’s official domain?

Are the links from the company/service’s official domain?

Do not open links or attachments unless the sender’s identity has been verified and you trust the source.

2. Enable Two-Factor Authentication (2FA) For All Your Accounts

[Getty Images]

Two-factor authentication is a security feature that adds an extra layer of protection to your online accounts. It requires two forms of identification before allowing access to an account.

For example, a password and a code sent to your phone. This feature makes it harder for cybercriminals to access your accounts even if they possess your login credentials.

If the sender requires you to “help them” clear your 2FA on your device, it is very likely a scam.

If you’ve accidentally given some information to the scammers, 2FA notifications may flood your devices.

These are from the scammers’ attempts at forcing entry into your accounts. You should consider changing your credentials temporarily so that the scammers lose their access immediately.

Spot The Scam!

For our next interactive exercise, can you identify the scams in these screenshots?

Did you get all 4? If you did, great work! Remember that legitimate emails usually do not ask you for your personal information first.

E-commerce Scams

“You can do all the research you want in the world, but if the seller isn’t an official retailer, you will always run the risk of getting scammed.” says Abigail, who went face first into a scam run on Carousell trying to purchase a Nintendo DS.

Either you get a faulty product, or you never receive the item at all— E-commerce scams have seen a rise in cases in recent years as the 2019 pandemic saw a dramatic shift towards online shopping.

Fake online stores, fake payment or shipping methods, fake reviews; e-commerce scams explore such vulnerabilities, making it easier for scammers to get away scot-free on many of these e-commerce platforms.

Carousell in particular has been known to host a hotbed of e-commerce scams for the past few years.

So how do you spot and prevent an e-commerce scam? Let’s take a deeper look.

Common Victims:

Impulsive shoppers who are easily enticed by fake sales and discounts, and are willing to overlook warning signs.

Being less tech-savvy on shopping platforms or payment methods can also play a part in the involvement with an e-commerce scam.

How to Spot E-commerce Scams:

[Singapore Police Force]

1. Unexplainably Low Prices

What they say: “Our iPhone 12 is only $90, you won’t get a better deal elsewhere.”

Offering products at a much lower price than anywhere else. Their reason for selling is not proportionate to the recommended retail price, or they’re simply too good to be true.

⚠️ These “incredible” deals that are way below market-price are often disguised as limited-time-only or flash deals. As Singaporeans, our thrifty culture, or being “kiasu” can be easily exploited by these methods.

2. Reviews For Credibility

What they say: “If you don’t trust me, just take a look at how many 5-star reviews I have.”

The seller has a lack of reviews to verify their authenticity.

⚠️ Be wary of fake reviews. Accounts can be bought or mass-created just to create reviews and make “good ratings”.

3. Shifting Communication Outside of the Platform

What they say: “Let’s talk on WhatsApp instead ok?”

The seller makes a continuous push to ask for your mobile number and communicate off the platform. This is done to keep their illegal activities off the record.

4. Insisting on Using Uncommon Payment Method

What they say: “I don’t use ShopeePay, you can PayNow me or pay by gift cards instead.”

The seller insists on bank transfers instead of using the online shopping platform’s secure payment options.

5. Forcing Immediate Decisions

What they say: “Do you want to buy or not? Someone say they want to buy already, let me know asap ok?”

The seller attempts to pressure you into making quick decisions on the spot. When you’re not allowed much time to think about it, you can become a little more rash in your decision to purchase and ignore certain red flags.

6. Defensively Using Documents to Prove Authenticity

What they say: “You don’t believe is it. Ok I show u proof.”

The seller proactively provides images for local bank account details, NRIC or certificates to increase their credibility and earn trust.

⚠️It has been brought to light that these images of bank account details are suspected to be ‘borrowed’. NRICs are suspected to be stolen, and certificates are suspected to be fake. This can make the seller seem even more believable.

How to Prevent E-commerce Scams:

Follow these tips, so you can reduce the risk of falling victim to fraudulent sellers:

1. Avoid Unknown Sellers

Buy items of value only from familiar or reputable online sellers.

Always avoid unknown sellers, especially if purchasing high-value items for the first time.

2. General Precautions

Are you buying from a trusted e-commerce platform?

Are all the fees stated upfront?

Does the seller allow for meet-ups for the item?

Always do a background research and evaluate the online seller’s profile before making any purchase decisions.

And remember to release payment to the seller only upon the buyer’s receipt of the item.

Where possible, insist on cash on delivery if a platform’s secure payment option is unavailable. In most cases, sellers would only require your contact details and delivery address.

3. Seller Evaluation

Is the seller located out of Singapore?

Does the seller have a positive track record?

Does the seller have genuine consumer reviews?

Does the seller offer a buyer protection refund policy?

Read independent reviews of the online vendor and customers feedback regarding the authenticity, quality and delivery of the product and after-sales service.

4. Pay via Cash or Through the Platform

Do not agree to any bank transfers, or strange payment methods outside of the online shopping platform.

Never give out personal information like your 2FA, NRIC or bank account number!

Actual Case Study

[Carousell]

From a July incident, there were fans who were unfortunate enough to be one of the 54 victims to pay big money on a Taylor Swift concert ticket resold on Carousell.

Since February this year, we’ve also seen similar scams on foodstuffs that even affected a local celebrity!

Tune in to an episode of Crime Watch to learn more about these scams in action.

Investment Scams

“I’ve always thought I was a careful investor. But when you see the amount of money you can make, you get greedy.” A victim describes his experience in hindsight, on a CNA Insider feature.

An investment scam is a fraud designed to deceive investors by falsely promising yields that they cannot keep. Pyramid scheme, Ponzi scheme, Multi-level marketing, offshore investing, and more recently, cryptocurrency; investment scams go through many types and names.

Such scams are often carried out by individuals or companies that lack any legitimate business operations or regulatory oversight.

If you’ve been keeping up with celebrity news, you’ll have heard of a cryptocurrency scam allegedly run by American influencer Logan Paul, or the $8 billion FTX crash late last year.

With that said, are you ready to dive into another rabbit hole of scammers?

Common Victims:

Investment scams often catch the interest of the financially greedy or vulnerable. This can range from the elderly or retired to young adults desperate for a solution to pay off their student loans and bills.

This doesn’t exempt wealthy individuals, however. As long as one is inexperienced with their money, they are just as likely to be scammed into investing.

How to Spot Investment Scams:

1. Guaranteed Returns

What they say: “Put in $500, and you’ll see $1,000 back in two months!”

The investment opportunity offers guaranteed returns that are significantly higher than what is generally available in the market.

2. Creating FOMO (Fear of Missing Out)

What they say:

“Brother, take the chance while u can now. The market won’t wait for u.”

“Everyone is buying it right now, you’re missing out!”

“If you invest now, you get an additional 15% credit!”

Now, now and now. Scam artists will often pressure potential investors and emphasise the need to make quick decisions. This is to prevent victims from taking time to research the investment.

They can do this by pitching the investment opportunity with fake testimonials to make the investment seem like a hot commodity. They will also target your fear of missing out using limited offers, timed gifts or rebates to make you commit quickly.

3. Lack of Transparency

What they say: “Trust me bro. I’ve been doing this for years, confirm earn back very fast one.”

The investment company tends to be unwilling to provide you with detailed information about the investment, including official documents like financial statements or investment prospectus (because they don’t exist!).

⚠️ One of the excuses that scammers use to obscure the origins of their investment opportunity is “hard-to-understand strategies”: If the investment company describes its strategy as complex or proprietary, it may be trying to hide something.

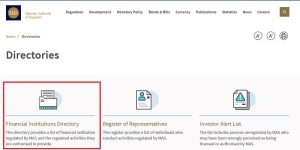

4. Lack of licensing

What they say: “Your investment is safe with us, don’t worry.”

Nine times out of ten, these investment entities aren’t regulated by the appropriate regulatory bodies.

⚠️ Unlicensed investment professionals are a clear sign of a scam! Some investment scams may even claim to be regulated by the relevant authorities to mislead you.

This is how offshore investing schemes operate; “promising investments” in foreign companies or markets with minimal regulatory oversight.

Always be aware that by dealing with an unregulated entity, you are also giving up on the safeguards offered under the laws established by the Monetary Authority of Singapore.

5. Offering “Commissions”

What they say: “For every friend that you refer to invest with us, we’ll give you $500!”

A victim may be incentivised to refer the investment entity to another person for a commission.

This is not something a legitimate investment scheme would practise.

The main goal of this “commission through referrals” is to encourage existing customers to bring in friends and associates to enlarge their investor base in a short amount of time.

This is also commonly seen in a pyramid scheme, where investors (victims) are recruited to buy into a company or product with the promise of earning commissions from recruiting other investors.

How to Prevent Investment Scams:

It is important to be aware and vigilant when investing. Here are the various ways to protect yourself from a fraudulent investment opportunity.

1. General Precautions

Are they offering high returns that are unrealistic to the market rate?

Is this an unsolicited investment opportunity?

Is the entity overly aggressive in pushing for you to invest?

2. Do a Background Check

Do not be too quick to believe everything you are told!

Can you find the company’s background?

Can you verify a positive track record from the entity?

Is the entity licensed under the Financial Instituitions Directory?

Are any of the ‘reputable’ individuals under the entity, listed under the Register of Representatives?

Is the entity blacklisted on the Investor Alert List?

When in doubt, ask the entity as many questions as you need to fully understand the investment opportunity. If it is unable to answer or avoids answering any of your questions, it may be a red flag!

3. Consult a Professional!

When unsure, always bring in a financial advisor like a representative from your bank, or a trusted attorney before making any investment decisions.

4. Avoid These!

Never give out personal information!

Do not feel pressured to invest quickly!

Do not invest with only surface-level information!

In all cases, the key to avoiding investment scams is to do your research, ask questions, and never rush into any investment without first conducting due diligence. Always investigate the legitimacy of a company, its management team and its financials before investing any money.

Love Scams in Singapore

Ever been cheated out of love? We’re not talking infidelity, but literally being cheated by a non-existent spouse? A stud you’ve found on Tinder; stunning looks, drives a spankin’ hot Porsche and is willing to meet you at a moment’s notice?

All with a catch, of course. This rich Canadian man of your dreams just has one obstacle in between him and a hot embrace with you: He can’t afford a plane ticket to Singapore for some reason!

Would one be so blind in love that they would fall for such scams? In a statistic revealed by busting scam syndicates in 2022, the S$33.3 million total in victims’ losses is the answer to that question.

Love scams, or romance scams, has been on the rise in Singapore recently.

As the entire operation is handled online, scammers can create fake identities to pose as a potential romantic partner via online dating sites or social media.

Once a target is hooked, the scammer will engage in a prolonged and intimate online relationship with the victim; often sharing stories about personal hardships, relating to the victim’s emotional troubles, as well as expressing their love and affection.

When the relationship reaches ‘maturity’ or when the victim has lost their guard completely, the scammer will start convincing and requesting money discreetly under various pretexts.

They may also feel emboldened enough to get away with more sensitive personal information, such as bank account or credit card details.

Love scams can be financially devastating for victims, with some losing thousands or even tens of thousands of dollars. It is important for people to be cautious when chatting with strangers online and to be wary of anybody asking for money or personal information.

Common Victims:

The desire for companionship stems from a desire for a physical and or an emotional connection. This is common among people who are lonely, vulnerable, and introverted.

Older adults, individuals with existing relationship problems, or those who are socially isolated are a few examples.

Having less experience with online dating or social media can also make it difficult for victims to spot the early signs of the love scam. You may be surprised, but there are hopeless romantics out there who will find affection through words alone.

How to Spot Love Scams:

[iStock/Tatyana Antusenok]

1. Excessive Compliments

What they say: “Wow your eyes are really pretty…”

The ”partner” will make an attempt to quickly bridge the gap between strangers by giving excessive compliments and affectionate messages. This can even happen right from the start of the conversation.

2. Not Meeting in Real Life

What they say: “Dear, my passport got stolen…”

The “partner” often makes different excuses and insists on only communicating through the dating platform.

3. Limited Personal Information

Evasive or giving vague and common replies when asked about their personal details or background.

⚠️ BEWARE! As scammers continue to rack up successful attempts at their deceit, they obtain more experience in hoaxing, and can even use ex-victims’ profiles to make their identities more believable.

4. Asking About Your Income and Savings

What they say: “Honey, how much money do you earn a month?”

When comfortable enough, the “partner” will begin asking about the victim’s income or financial situation in order to gauge if it is worth their time.

5. Inconsistencies in Stories

What they say: “Oh, yes, John was at the party too. I remember John now.”

The “partner” will have stories that are inconsistent or might not add up, and often backtracks on what they say. They often forget the settings of their stories, and may attribute them as forgetfulness or various other excuses.

6. Asking For Money

What they say: “Dear, do you happen to have $500 I can borrow first? I promise I will pay you back.”

To reassure the solidity of their relationship, money becomes involved. The “partner” will ask for money, such as to help with travel expenses to meet the victim, or medical bills with the claim of repayment.

There are various reasons they can come up with to make the victim sympathetic towards their plight. However, they’re always “needed urgently”.

7. Guilt Tripping / Gaslighting

What they say: “You would buy me this if you really loved me.”

When the relationship has progressed considerably, the “partner” will begin to manipulate the victim’s emotions in order to persuade them.

The scam counts on the emotional connection that was built up for some time, in order to peel away the victim’s initial reluctance to give them money.

How to Prevent Love Scams:

[Singapore Police Force]

Online dating has become a norm in our need to simplify many social aspects of our lives. It is more important than ever to take note of these points to avoid a potential love scam!

1. Slow Down!

Take your time with your potential partner!

Don’t rush into anything too quickly, no matter how appealing it may seem.

Take your time to get to know the person in person!

2. Check Your Chatlog!

Are they a little too eager to meet or chat with you?

Are they sharing too many sob stories?

Are you getting questions related to money?

Do they seem inconsistent with details on the stories they share?

Do they have frequent grammar mistakes?

Yes to any of them? Proceed to the next step!

3. Verify Identity!

Use online search engines to check if the person’s photos and claims match their identity.

Check social media and dating sites to see if their profiles match or if they have a history of scamming or catfishing.

Request a video or voice call! If the “partner” repeatedly avoids meeting face-to-face with you, nine times out of ten, that’s a scam!

4. Avoid These!

Don’t share personal information like home address, work details, or bank information with someone you meet online.

Do not assist with monetary issues online.

Actual Case Study

We take a look at a case in 2021, where a 20-year-old graphic design student was scammed of S$2,100 when gaslit by “Lin Fei” to splurge on an “in-game marriage” for her.

“She was playful and friendly. I was just going with it and didn’t think much of it.” The student mentioned, along with a comment that “Lin Fei” had complimented him often and confessed to him early on during their relationship.

Late 2022, another case surfaced involving a single dad who lost S$110,000 from the love scam. He had put the money into a gold-trading platform at the request of his “girlfriend”.

“She appeared at a time when I felt the most helpless. She showed concern for me, and said she would accept my two children,” the Singaporean dad said.

In another case, Wang, a middle-aged retired woman became the target of not one, but two scams over the course of under two years! Losing over S$15,300, Wang not only took money out of her savings, she’d also borrowed huge sums from her friends at church, her pastor, and her relatives.

When confronted, the scammer seemingly mocked Wang behind a string of messages, taunting her that she cannot do anything about it.

As a victim, you may truly feel powerless and taken advantage of emotionally. While scams will continue to amass similar victims like a countrywide plague, our government has too, taken appropriate measures in order to combat this growing issue.

Singapore’s Efforts to Curb Scams

[Today]

As a Singaporean, it is worrying to hear about the increasing trend of scams in Singapore taking place. It is unfortunate that as long as there are vulnerabilities in the system, we remain at risk of falling victim to such schemes.

It is not just about losing money, but the loss of our trust in our local financial institutions.

Fortunately with the public’s worries at an all time high, many government initiatives have been pushed forward.

Existing Initiatives

One of the existing initiatives is ScamShield— An on-device algorithm that filters your SMSes against a database of known scams, and acts as a safety barrier between you and a potential fraudster.

You can set up ScamShield as a WhatsApp bot to automate unknown messages there, or simply download it as a mobile app for Android or iOS to automatically detect potential scams!

Since its launch in November 2020, ScamShield has successfully reported more than 22,865 SMSes, with more than 5,537 suspect phone numbers blocked on the app.

[ScamShield]

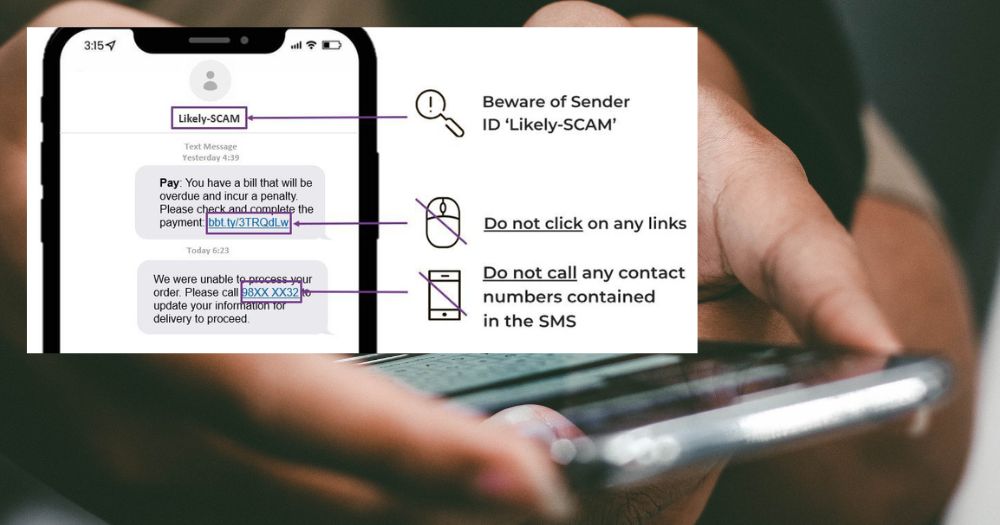

Have you also come across messages with a sender ID “Likely-Scam” over the past year?

You can thank the Infocomm Media Development Authority (IMDA) for this!

“Likely-Scam” alert is another SMS safeguard brought forward to increase our wariness towards unregistered sender IDs.

[Mothership]

When we shop online, how do we know which platform(s) to trust?

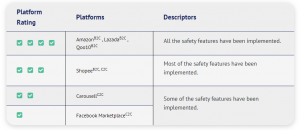

With the implementation of the E-commerce Marketplace Transaction Safety Ratings or TSR, we as consumers can keep up to date on the trustworthiness of popular platforms like Shopee, Lazada, Qoo10.

This allows us to assess risks better as a savvy consumer and avoid sketchy platforms.

New Plans for Scam Prevention in 2023

Apart from the above three existing initiatives, the government has also introduced new plans for scam prevention in 2023.

This year, Minister of State Sun Xueling spoke at length at parliament, outlining a roadmap on effective measures against scams in Singapore.

We’ll just give you the 3 important cliff-notes so you’re all caught up!

1) More partnerships implementing technology to block scammers more proactively. This means more effective ways to prevent their usual unsolicited calls, SMSes, online listings and websites.

2) Raised security on government service and banking channels. This means scammers will have a harder time getting to us using system vulnerabilities.

One example would be to remove clickable links from official emails and SMSes, reducing the risk of phishing attempts.

3) Laws will be tightened against scam-related movements.

This will become a deterrent for the money mules who will now be a target of prosecution when investigated under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act.

Emphasis on Public Education

It is also important for us to be knowledgeable of the latest scams as well.

The government has poured resources into educating the public on these matters yearly, keeping us up to date with these anti-scam campaigns.

This year, the catchphrase of the campaign “ACT against scams” is an easy-to-understand acronym.

[The Straits Times]

Adding security features.

Checking for scam signs and with official sources.

Telling authorities, family and friends.

You’ve probably seen a similar standee around your neighbourhood during these past few months. Even if you’ve passed one by, infographics like these serve a very important purpose in creating an unconscious awareness and call-to-action towards scams.

As a citizen of Singapore, we should do our part in recognizing and reporting scams locally, so that we and our loved ones are well-protected against fraudsters.

Conclusion

[Pexels]

It’s easy to talk about scams, and stress the importance of early prevention. But nothing hits harder when you’ve experienced the side of the story as a victim.

I would like to close off with a story from a close friend of mine, Alex.

Alex was contacted by “Margaret” on Facebook claiming to be a journalist in Australia. Finding common interests, Alex began to find himself attracted to “Margaret”. That attraction began from simple compliments, and it didn’t take more than a week for him to fall for “her”.

Alex was so blindly in love that by the end of their 4-month relationship, he had lost $18,600 total in iTunes cards and wire transfers.

Alex was a fresh university student who came from a low-income family at the time, and his “love of his life” had completely taken away his financial plans for the next 5 years.

Even after his depressive episodes completely recovered, Alex still struggles with the financial aftermath of his mistakes till this day.

No one should ever pay $18,600 as a life lesson like Alex.

Thus we have compiled our comprehensive guide to scams in Singapore, so that we can learn to prevent these mistakes from ever happening.

Only by staying informed and taking proactive measures, can we protect ourselves and our loved ones from the scourge of scams in Singapore.

Here are a few articles to read up on similar topics:

How to protect your child from unwanted online exposure?

Singapore Parents: Should You Let Your Kids Use the Internet?

There is also a skit on the re-enacting of a scam here on YouTube: