Man, oh man. We’re here again talking about e-commerce scams.

You know, it almost seems like it’s only been a week since we’ve last talked about the latest trends of scams in Singapore. But they’re back at it again! Just this month alone, we have victims on both Carousell and Facebook losing upwards of S$314,000.

Carousell, which is once lauded as one of our popular online marketplaces to buy, sell and trade goods, has progressively become a hotspot for scammers to pull off such devious stunts.

That’s right! With the increasing convenience-turned-reliance on e-commerce platforms to do shopping, many Singaporeans have begun to fall into the crevices of traps planted by scammers in the platform.

I don’t know about you, but if I’m someone who’s specifically looking to sell on Carousell now, you might want to keep an eye out on things that’ve been heating up as of late!

A Bag of New Tricks: The Fake-Buyer Scam

[CNA]

We’ve all heard of the old retail scams, where deposits or even full payments were taken without giving their end of the deal. Since meet-ups and more secure, trackable methods of payment have been secured on the platform, scammers no longer rely on such a see-through method.

Gone are the old-fashioned methods that were widespread 5 years ago, e-commerce scams have since become much more advanced… and this is not a good thing!

Enter the latest, but definitely not the last iteration of the average e-commerce scam! What has spawned out of the earlier part of 2023, was something called the “Fake-Buyer Scam”.

What is the Fake-Buyer Scam

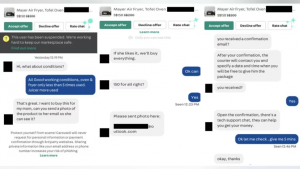

As part of yet another phishing scam variant, scammers will pose as fake buyers on Carousell.

The finessing of a Fake-Buyer Scam starts when you, the victim, gullibly trusts that the other side is a genuine party, leading you to accept payment methods outside of PayNow and other traceable means of money transfer.

“I don’t have PayNow, can I use [suspicious website] instead?”

Feeling a little more lenient just to make the transaction smoother, you decide to trust it.

Then, you take the scammer’s bait and access a spoofed website through a given link, which will in turn ask for banking details to facilitate payment or delivery.

It is obvious at this point that no trusted website will ask for payment, order confirmation, or card details via external sites or email!

Indeed, the Fake-Buyer Scam comes in a few variants while they are setting up the bait, but their modus operandi remains relatively the same.

An email, shortened website link or QR code that brings you to their spoofed page, your bank account details, and finally, a request to provide your bank’s 2-Factor Authentication.

No matter if the money is savings for your child, or you’re a student just scraping by, these scammers will resort to anything… and I mean ANYTHING to reach your money.

Disguising their spoof attempts as CarouPay emails? Or even “paying for extra” because of the trouble?

As long as it’s not PayNow, PayLah, CarouPay or any of the legitimate payment methods approved on Carousell, be doubly careful with the transaction!

The Negative Press on Carousell

Naturally, the source site is bound to take the heat for allowing these incidents to happen on its own platform. One of its most immediate losses is the e-commerce safety rating, as Carousell was ranked as the bottom two in an annual report by the authorities.

Many have also lost trust in the digital payment system, reducing the credibility of the platform’s own method of payment: CarouPay.

It is inevitable that Carousell has taken the flak in the form of a lowered reputation locally, as scammers continue to produce frightening numbers in both their loot and their victims.

Carousell’s Anti-Scam Efforts

[Carousell]

Of course, Carousell will not simply sit by idly and let scammers run their platform. Since the seriousness of the situation has been brought to light, the management is more determined than ever to purge scammers off their platform.

AI Detection of Potential Scammers

For one, Carousell has become more involved with the use of artificial intelligence and machine-learning tools to detect and suspend users who send QR codes in high-risk scenarios.

Phone Verification

Platform users are also cushioned with an additional requirement to verify their mobile numbers before they can initiate a chat or make an offer for a product. This would be their first layer at attempting to filter out the bad actors.

The Platform Will Buy From You Instead

[Carousell]

The next measure they would implement is a new feature where the client becomes Carousell as the broker instead! Under this programme, users can sell certain items of value like electronics or branded clothes and accessories to Carousell for cash. This way, item authentication and sale certification becomes none of the sellers’ problems.

“We know buying high-priced second-hand items may be risky, so we are systematically introducing features to mitigate those risks and making the experience similar to that of buying new items.” Carousell commented.

Highlighting Suspicious Users

Next, the platform will also maintain an in-chat banner that alerts users when they are chatting with potentially suspicious or suspended accounts.

This was done in an attempt to highlight the importance of conducting transactions solely within its platform, as scammers always attempt to redirect conversations to external platforms before their accounts are flagged.

“By staying within Carousell for your chats, you will also receive notifications if the user you are conversing with has been suspended,” the platform highlighted.

Cliff Notes From the Police Advisory

[SPF]

But of course, we take vigilance and safety in our own hands. To that end, we can learn from lessons brought to you by our local police!

“Add, Check, and Tell.”

ADD – Download the ScamShield App and set your security features like 2FA-enabling, multi factor authentication for banks and set transaction limits on internet banking transactions, including PayNow/PayLah).

As the saying goes, “Never disclose your personal or internet banking details and OTP to anyone!”

CHECK – Look for signs of scams and consult official sources (e.g., visit www.scamalert.sg or call the Anti-Scam Helpline at 1800-722-6688). Avoid clicking on suspicious URL links and consistently verify the authenticity of such links. When in doubt, always confirm the information’s authenticity directly with the e-commerce platform.

TELL – Inform authorities, family, and friends about any scams. If you encounter fraudulent transactions, promptly report them to your bank. Additionally, report any suspicious users and fraudulent transactions on the online marketplace to the e-commerce platform.

With that, you should be good to go! If you see a scammer looking to ‘buy’ your listing outside of the platform, make sure to do a double take on what they’re asking for before making your own informed decision!