Display figurines of the Marvel universe to collector-graded Pokémon cards.

There’s no need to introduce these collectibles to the younger generation.

Take a walk around your local mall. If you look closely, there are hobby stores accommodating all sorts of hobby products.

They exist, because people from all ages share these hobbies, and can part with large sums of money just to own these items. It’s common for your parents to nag a little on how unwisely you’ve spent your money when they find out. But to you, that $150 shiny Charizard card you’ve bought is too RARE to pass up!

“Too rare” huh, you probably didn’t NEED a piece of cardboard that cost pennies to make. It ends up sitting on a display case, and doesn’t do anything beside looking nice and fancy.

Do you feel comfortable spending that much for something that you don’t really need? Is consumer culture influencing your decisions?

But hey, we’re not telling you how to spend your money. After all, we get it.

Having hobbies keeps you from feeling like you’re living a dull and boring student life.

But sometimes, there’s times when you go “too far” into splurging on your hobbies. At times like these, you need an objective view from a third party to ask the hard-hitting questions:

Are you spending too much? If so, how much should you spend on your hobbies?

What is Consumer Culture?

[HardWareZone]

Before we question all that spending you’re about to do on that next-gen gaming console, we need you to understand the idea of why and how we are so engaged with material goods.

What makes us comfortable throwing money at things that we want, not things that we need?

Well, this itch to spend outside of necessities is part of consumer culture.

It means that you are influenced and encouraged to spend on material goods and services.

How is Consumer Culture Spread?

[Freepik]

This culture didn’t spread overnight. Stemming from its western origins, it’s an influence that has slowly crept into many first-world countries like ours. Today, we still see how consumer culture is being sustained. They’re all too familiar for all of us:

What with all that unskippable YouTube ads playing, reminding you of what the new MacDonald’s menu looks like. Or banner ads as you scroll through social media sharing the latest brand discounts.

Products are pushed through media exposure and social pressures… or social media, a blend of both! We’re the consumers, and the majority of consumers are not immune to social media marketing— We see these products painted in bright and flashing lights, giving us the compulsion to buy these “must-haves”!

How Does Consumer Culture Affect YOU

Society wants YOU to feel the fear of missing out, or FOMO. They want to implant that feeling at the back of your mind that their product, the “thinnest wallet ever made”, is the best product in the market right now!

The way you perceive the value of products changes over time, as you begin to ‘appreciate’ more than what you’re getting. You want to learn about how it’s made, the intention behind its make, and “why it’s worth that much”.

But really, you don’t actually want it more than you think!

Yet the products keep selling. The lineup on the shelves continues to sell in a never-ending cycle:

Branded watches. New Nike sneakers. New video games. Everything new is good, and everything “old” is “not the best”. We feel like the longer we hold on to “old” products, the more we’re “outdated” from the rest of society. And when we keep buying things just to keep up with what’s new, we develop an unconscious habit to “replace” instead of “recycle”.

[StockGro]

Because why is there a need to get the new iPhone 15 exclusively made of titanium, when your iPhone 12 is working just nicely?

Still, we don’t want to say that consumerism is wrong. Being drawn to your materialistic desires is normal. After all, you don’t just live life to fulfil the bare minimum of food, water and sleep. Most of you would prefer to enjoy life on your own terms; buy the things that you want, do the things that you like.

When you’re younger, you wanna’ be a little more wild. Buy things that you probably wouldn’t as an adult worrying about living expenses. But it’s important to set a limit for yourself. You can go fully unhinged and fall for all the marketing YouTube throws at you, but at least know what you want more than others, so that your wallet doesn’t cry.

How to Spend Wisely as a Student

It all starts with your sense of money.

You have to be aware of the risks of overspending. Tone down your inflated perceptions of value for the things that you’re about to buy, so that you can make a more informed decision.

Sometimes, you don’t even know that you’re overspending. As a student, you may already have started doing part-time jobs. Or perhaps you have money saved up from the new year and special occasions. That money seems like a lot, and if the price is right, you’ll just drop it like it’s nothing if you saw something that you conveniently wanted.

Let’s… not do that, shall we? To prevent trigger-happy purchases, let’s talk more about it.

Determine Your Cost of Living

[Freepik]

Do not take money out at the expense of your current lifestyle!

Yes, your current lifestyle is your priority.

As a student, you may not be subject to the stresses of living just yet. Many of you may still be living with your parents, and probably will for a long time. Let’s not talk about monthly rent, and all the meals your family prepares shall we?

If we talk about what’s for lunch, or your trips down to the bus or MRT, and maybe textbooks, that’s your current cost of living. (Pss! If you’ve got other expenses, do note it down altogether too!)

Say even your allowance is given to you, so we’ll assume that’s the “income” you’ll get weekly or monthly. Now, let’s say there’s the Charizard card you wanted to buy again. You have a $75 weekly allowance from your parents, so it’ll cost you… two weeks to afford it.

Deciding How to Save Money

[MustShareNews]

You think about how you can do this. Maybe bring the biscuits from home for lunch, and eat even less than usual for dinner. Walk to school instead of taking the bus. That is the extent of cutting down on your current standard of living, in exchange for that shiny Charizard card. That’s usually the kind of thought process students have when they want to “save money” without a consistent income.

Seeing the Bigger Picture When You “Save”

You know what we’re gonna say. No, cherish your body. Please don’t do all that just to save yourself something you can’t actually afford!

Have you not heard of the horror stories of gastric pains that carry into adulthood? Those improper, cheap diets that you’re having surely aren’t going to help! And what about the savings from transportation? Are you sure you wanna’ use all that energy walking the distance every morning?

Can you realistically spare that kind of time and energy to wake up early that way? Did you factor in the fact that you’ll be sleeping even earlier or less to compensate?

Students already have complaints of too much homework, and too little time. With various school stresses piling up, do you want to give up on that quality sleep?

Being Realistic With Your Hobby Expenses

Let’s talk about the hobbies that’s going to cost you that arm and limb.

Whether it be collecting figurines, playing trading card games, fiddling with consoles and PCs for the latest Triple-A titles, your hobbies often come with hefty expenses. Not all of them, but we’re talking about those that do.

We’ve got a broad crowd here when we’re classifying all of our readers as “students”. There’s age groups to consider, what parts of their lives they’re at, what kind of commitments they have, and of course, what hobby they’re spending on!

After all, all sorts of hobbies exist out there. All sorts of communities, big and small, determine the value of these goods. We’ve got retro video game groups, custom keyboard enthusiasts, antique card game collectors, old currency collectors— The list is non-exhaustive, and the more you look into it, the more you discover that people can really make a hobby out of almost anything!

Whether they’re mass-produced, or handcrafted, maybe even imported from countries of origin, the goal is to derive fulfilment from hobbies without compromising long-term financial stability.

Determine Your Level of Investment

Your level of investment shows not just the amount of money you’re planning to spend on the hobby, but also your general commitment.

Consider it carefully, especially if it’s a big purchase! There are people who suffer because they are impulsive buyers when they see something that catches their eye. And on the next day, they look at what they’ve purchased, and begin to regret it.

“I bought this plushie because it looked cute. But where am I going to put it? For a decoration, it really isn’t worth $60…”

This buyer’s remorse is another reason we need to hold ourselves back from succumbing to consumer culture.Before you’re using X dollars on Y, ask yourself this:

Is Y worth that kind of money? How much “happiness” can I get from Y?

For how long can I enjoy Y after its purchase? Is it cost-effective?

Am I sure I’m not going to regret this? If so, can I give any reason why I can consider this expense to be “worth it”?

What do people around me think about me spending X on Y?

Consider it from their perspective. Why do you think that you’re “wasting money” on Y?

When you’ve asked questions up to a certain point where you feel like you no longer have doubts, that is when you’ve ascertained the value that the purchase will bring. And to YOU, the expense is fully justifiable.

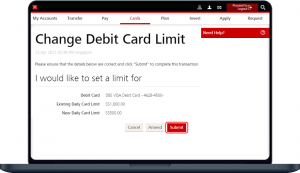

Setting A Limit

[DBS]

Keep tabs on how much you’re spending, ESPECIALLY if your hobby involves some kind of recurring payment plan. Maybe you’re deep into PC games. Certain titles or genres in the gaming industry involve the need to pay for “regular subscriptions” so that you’re kept “up to date” with other players.

When this is the case, nothing your purchases down can show you how much you’ve actually spent on a regular basis. This can either show you how expensive or affordable your hobbies can be, as you record them alongside your living expenses.

Sometimes when you’ve paid too much, you just gotta’ STOP.

If you’d like to hear what netizens are spending on their hobbies, you can check it out here!

Maintaining Your Hobbies With a Healthy Lifestyle

[Freepik]

Well, that’s all we have to cover when it comes to general advice.

But of course, there are also outliers that can skew that perception of value in your head. The fear of missing out, the way modern marketing panders towards your vulnerability to consumer culture et cetera.

As city dwellers, we are never truly free from “needless spending”. Especially when students and adults alike feel the stresses of living, spending a little on your hobbies to alleviate them doesn’t feel like a bad thing.

Moderation is always key. A balance should always be made. And the earlier you learn about financial prudence as a student, the better you’ll be at laying down ground rules for yourself in the future. You’ll be handling more money as an adult, but you’ll rest easy knowing that you won’t go ape-brained when you see the next “shiny Pikachu card”!